Is Warren Buffett changing course as Berkshire Hathaway Reveals £800M+ Investment in Crypto-Focused Bank

Also, this Warren Buffett-inspired stock market indicator just reached a record high - could this be a warning to retail investors like yourself?

Warren Buffett’s Berkshire invests in NuBank which is known recently for its crypto investments

Billionaire investor Warren Buffett, known for once calling Bitcoin (BTC) "rat poison squared," appears to be softening his stance as Berkshire Hathaway reveals a significant stake in Brazilian bank Nu Holdings, which operates its own crypto platform.

According to a November 2024 13F filing with the U.S. Securities and Exchange Commission, Berkshire Hathaway holds over 86.43 million Nu Holdings shares valued at more than £893.52 million ($1.1 billion).

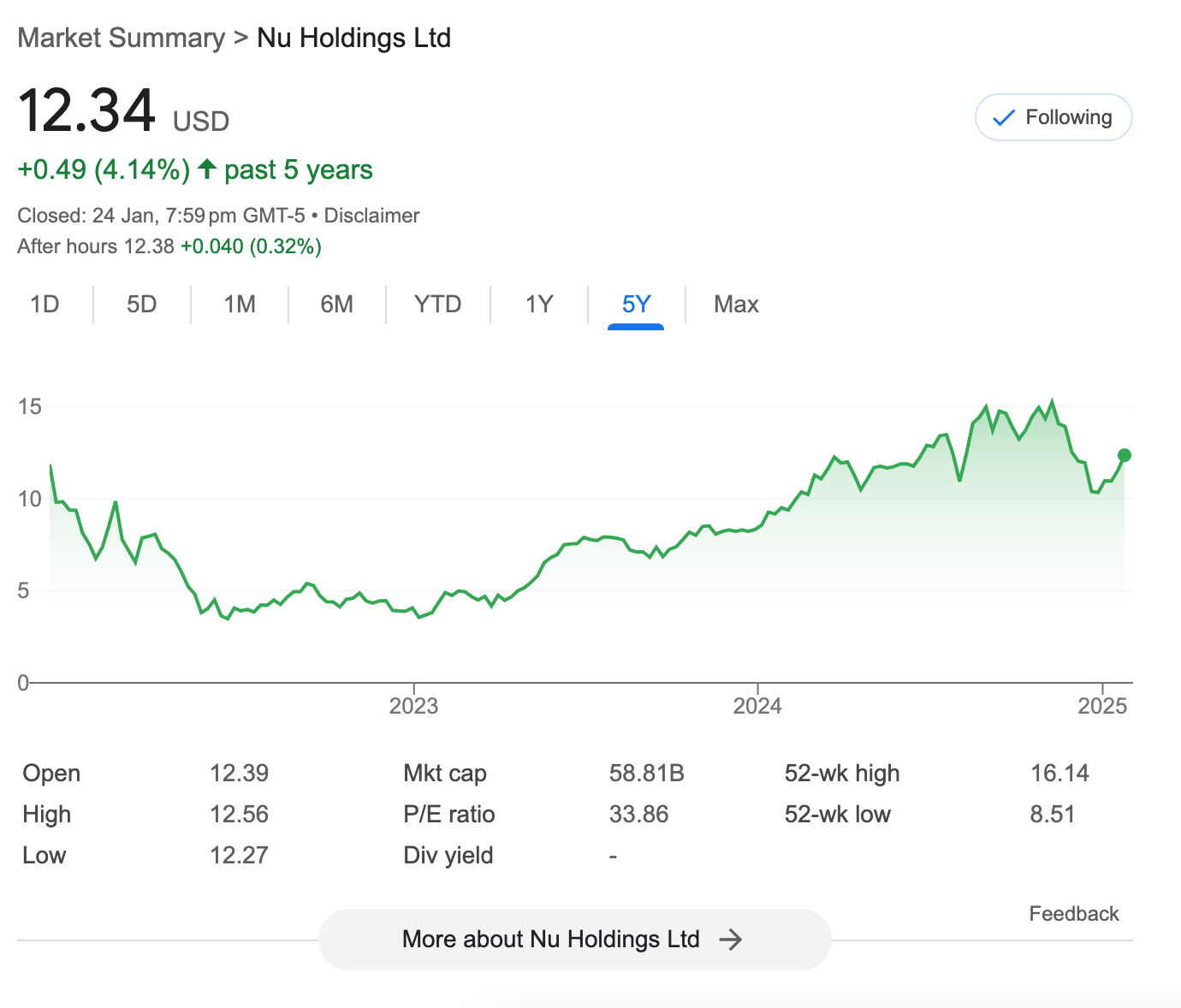

Nu Holdings, the parent company of Nubank, has seen its stock price surge by over 34% year-over-year. Berkshire initially invested £406.14 million ($500 million) in Nu Holdings during a 2021 Series G funding round, followed by an additional £203.07 million ($250 million) investment.

In 2022, Nu Holdings launched Nubank Cripto, a platform supporting major cryptocurrencies like Bitcoin, Ethereum, and Polygon. It has since expanded to include Uniswap and Chainlink, enabling users to transact and convert digital tokens seamlessly.

Warren Buffett’s Evolving Perspective on Cryptocurrencies?

Buffett, often dubbed the "Oracle of Omaha," has long voiced skepticism about cryptocurrencies, emphasizing his preference for investments he fully understands.

In 2018, he predicted a grim future for digital assets, stating, “In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending.” He also declared that he would never take a position in cryptocurrencies, either long or short.

In 2022, Buffett doubled down on his criticism, arguing that Bitcoin held no inherent value. At a shareholders meeting, he remarked, “If you told me you own all the Bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it? I’d have to sell it back to you.”

However, we doubt that Buffett invested in NuBank for the crypto portion - it’s for NuBank’s strong fundamentals

1. Betting on Emerging Markets

Nubank is based in Brazil, part of the fast-growing Latin American market. Buffett has historically shown interest in emerging markets with strong growth potential, and Nubank fits that profile.

With a rapidly expanding middle class and an underbanked population in the region, Nubank taps into a massive growth opportunity by offering accessible and user-friendly financial services.

2. Fintech Disruption

Buffett has often invested in companies that disrupt traditional industries, and Nubank is doing just that in the banking sector.

As a digital-first bank, it eliminates many inefficiencies associated with traditional banking, appealing to younger, tech-savvy customers. Berkshire's investment reflects a recognition of the potential for fintech to reshape financial services.

3. Strong Fundamentals

Even beyond its crypto offerings, Nubank’s core business is strong. The company has grown rapidly, scaling its user base and building a brand that resonates with millions. For Buffett, a company with solid fundamentals and significant market penetration is an attractive prospect.

4. Low-Cost Business Model

As a digital-only bank, Nubank operates with lower overhead costs than traditional banks, making its business model appealing. This efficiency helps it remain competitive and profitable in a region where traditional banking fees are high.

Berkshire is holding a lot of cash - Warren Buffett seems to be accumulating cash as a ‘war chest’ when the market crash or when his favourite stocks are undervalued

Despite its foray into Nu Holdings, Berkshire Hathaway remains committed to its conservative, value-driven investment approach.

Guided by Buffett’s principles, the company has been amassing cash reserves, which reached £263.75 million ($325 billion) in late 2024, primarily held in U.S. Treasury bills. This cautious strategy contrasts with a broader market rally fueled by speculative investments.

As Meyer Shields, managing director at Keefe, Bruyette & Woods, noted in November 2024, “Berkshire has succeeded over the decades by being boring in that way.”

A stock market metric famously associated with Warren Buffett is raising red flags

Known as the Buffett Indicator, this metric compares the total market capitalization of all publicly traded U.S. stocks to the country’s gross domestic product (GDP).

Experts are sounding alarms as the indicator has hit a record high, surpassing levels seen before the dot-com bubble burst. This suggests the stock market may be overvalued and at risk of a downturn.

As of November 2024, the Buffett Indicator reached a staggering 230 percent, according to data from Kailash Capital Research.

The last time the market-to-GDP ratio approached this level was in March 2000, when it peaked at 175 percent, as reported by Fortune.

When company valuations significantly outpace GDP, it can signal that businesses aren’t generating enough real economic value to sustain those high valuations. GDP represents the total sales within the economy, so when company values far exceed it, it raises concerns about whether those valuations are justified.

Disclaimer: This article is for educational and entertainment purposes only. It should not be considered financial advice, and readers should consult with a qualified financial professional before making any investment decisions. The opinions and information presented here are based on publicly available data and are not intended to serve as an endorsement or recommendation of any particular investment. Always do your own research before investing.